← Home

Great Southern Bank Credit Card Migration

Background

Problem Statement

Role

Senior UX/UI Designer

Timeline

6 Months

Tools

Figma, Workshops and Adobe Anlytics

Design Principles

- Clarity before action – Customers should always understand what’s changing, when, and why.

- Continuity of service – Card usage should feel uninterrupted wherever possible.

- Progressive disclosure – Information revealed in stages to avoid cognitive overload.

- Confidence through consistency – Messaging, UI, and support responses must align across channels.

- Risk-aware design – Prioritise error prevention over recovery.

My Approach

1. End-to-End Scope Mapping

I began by identifying and cataloguing all affected touchpoints, including:

- Website content

- SEO

- Mobile banking app flows

- Card management screens

- Transaction and notification experiences

- Customer service scripts and FAQs

This allowed us to understand dependencies, edge cases, and downstream impacts early.

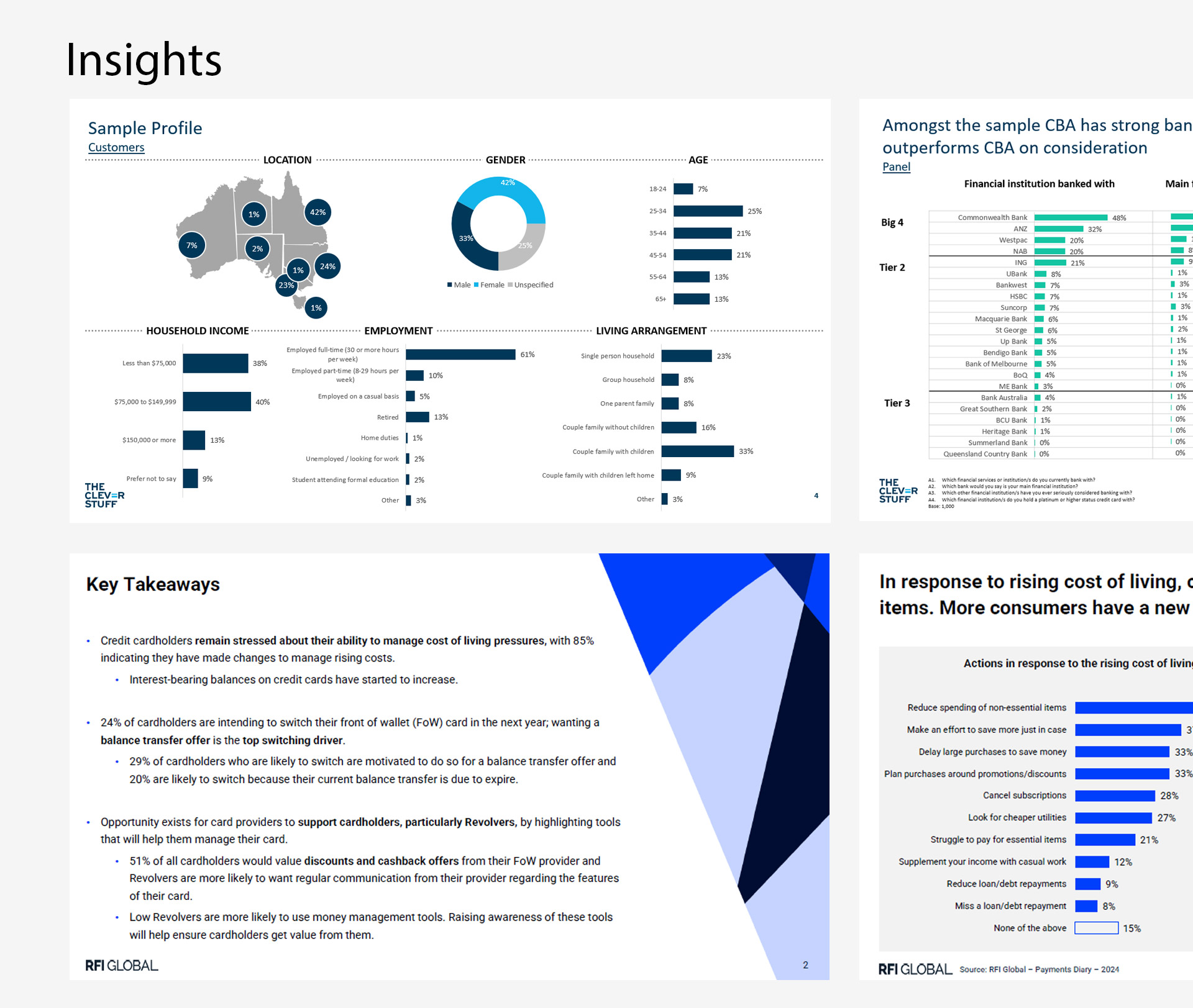

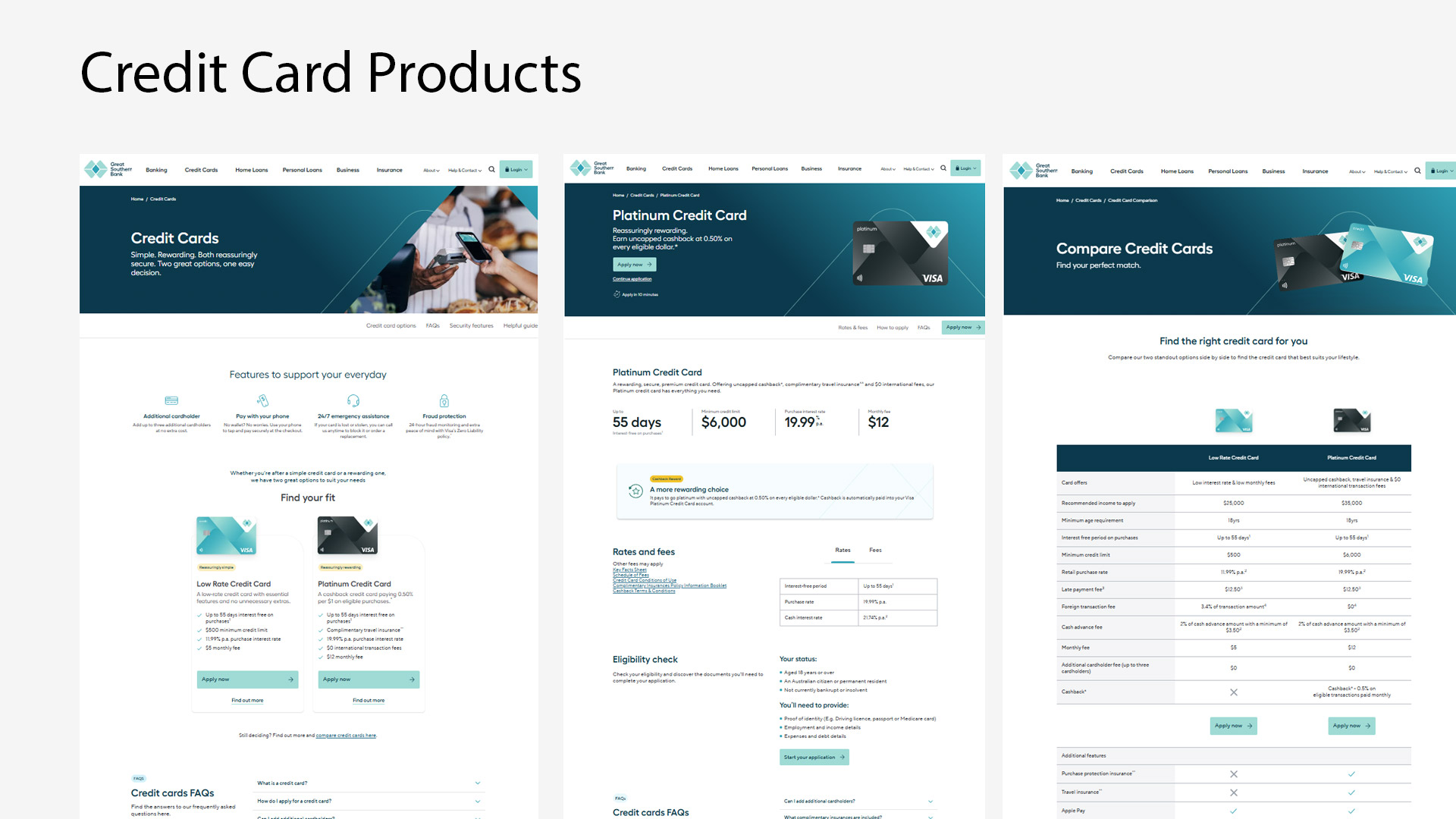

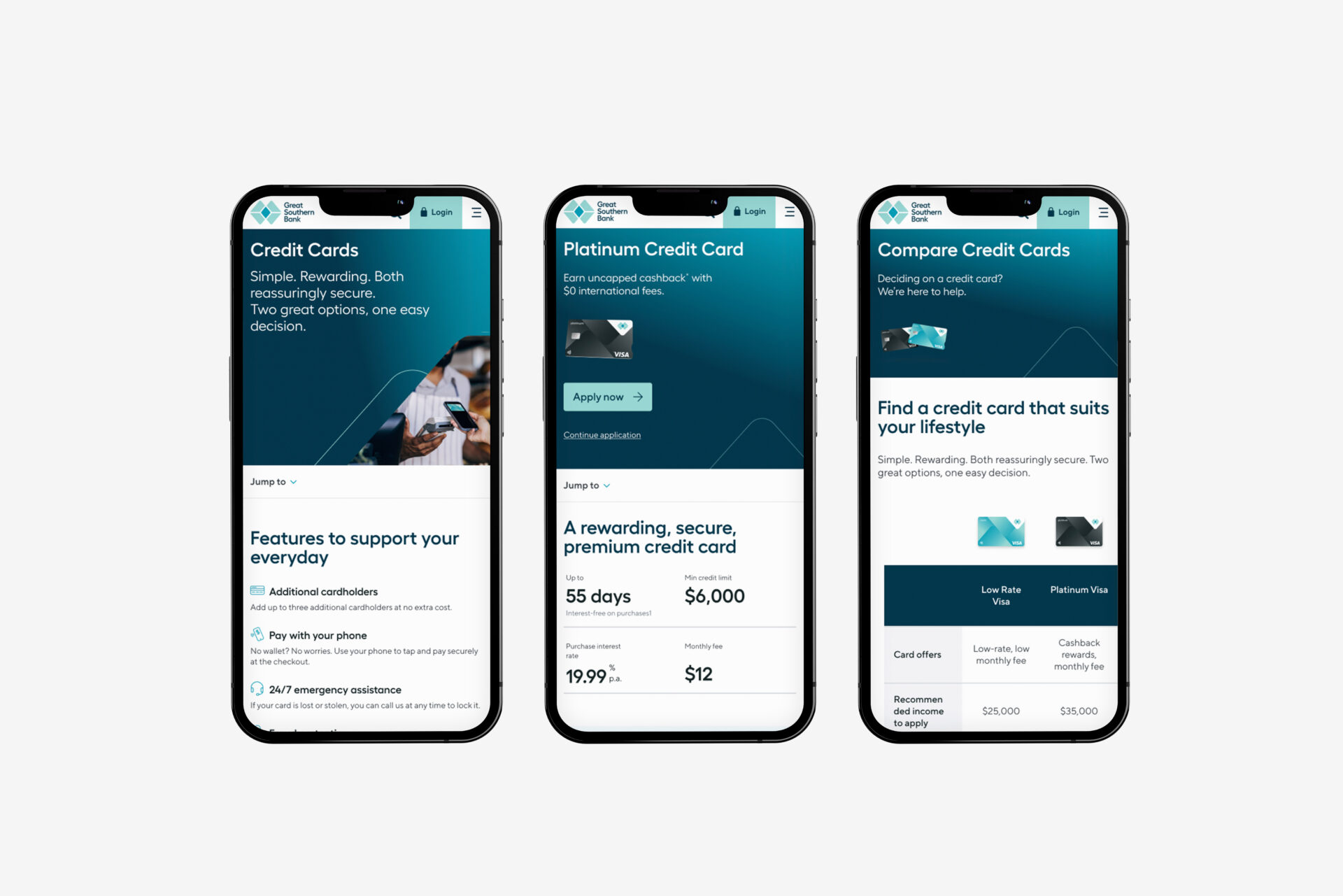

Credit Card Insights

2. Stakeholder Alignment

Collaborated closely with Product & Engineering, Operations & Customer Support, Compliance & Risk, Marketing & Communications, and Creative & Digital Experience teams.

Facilitated workshops to aligned on migration phases and constraints, defined customer impact scenarios, and established clear ownership across teams.

3. Customer Journey Design

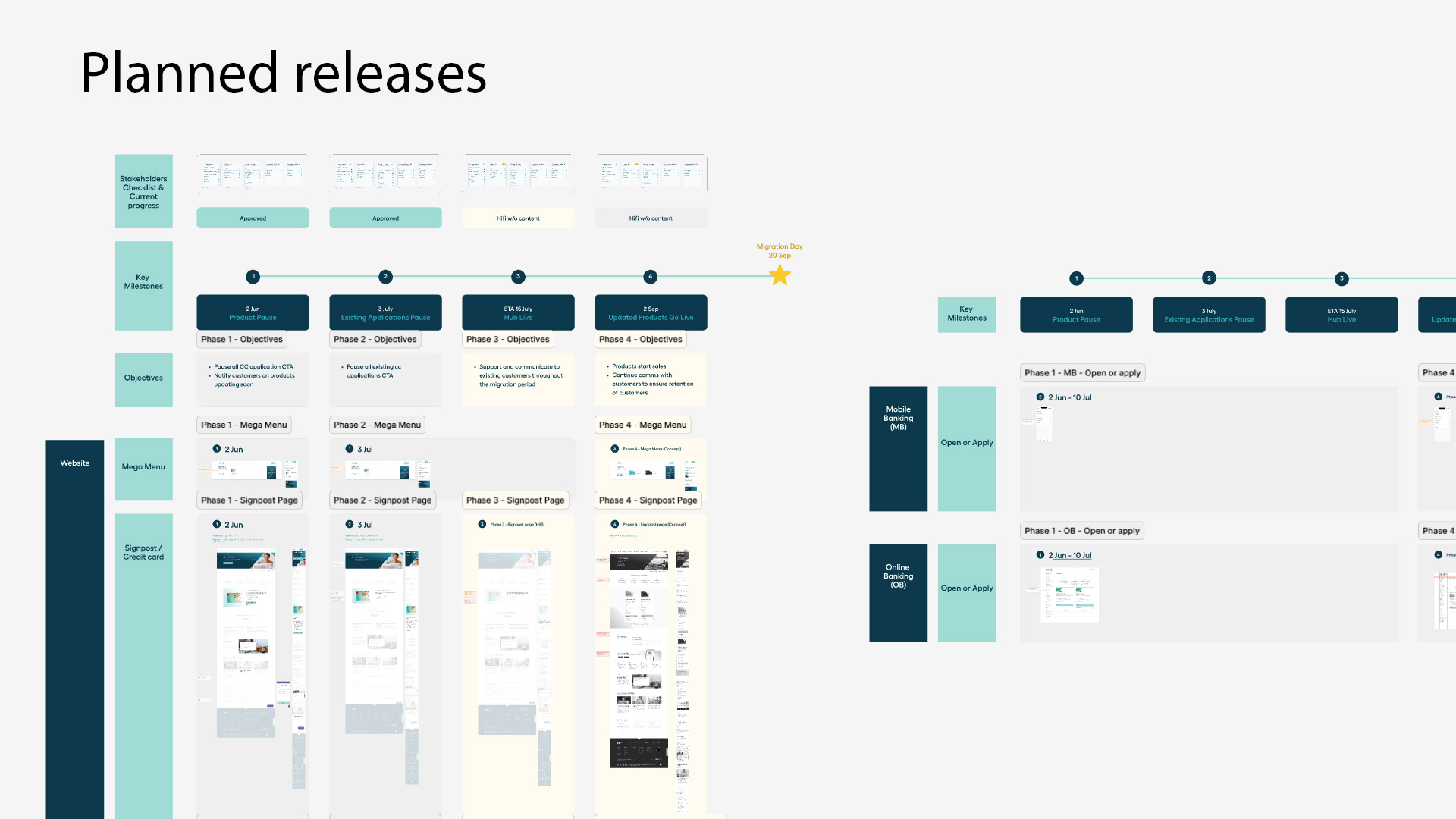

Mapped the customer experience across four phases:

3.1 Pausing Sales

Credit card sales were intentionally paused to reduce risk and ensure operational readiness ahead of the migration.

3.2 Before migration

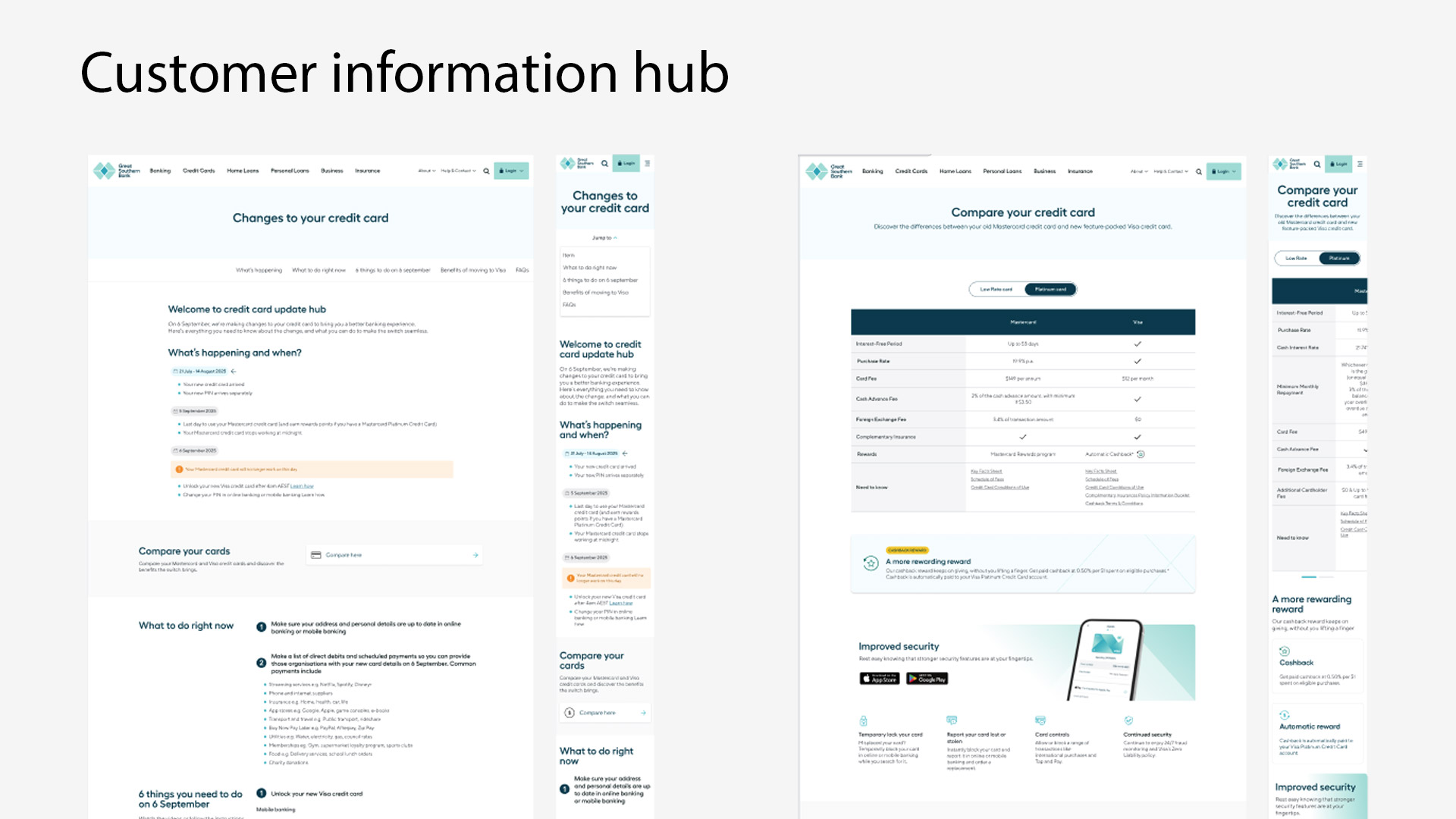

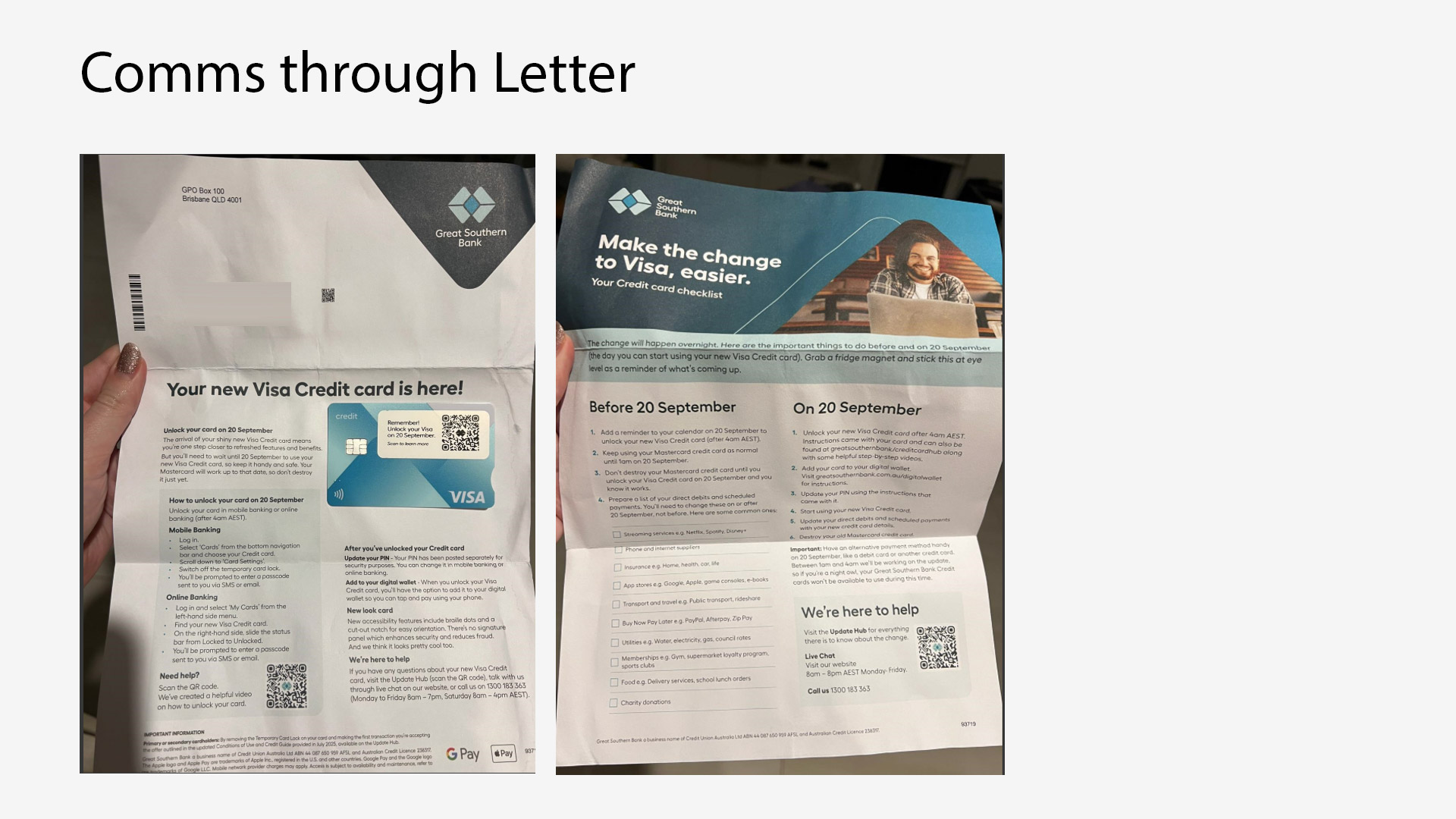

Customers were given clear advance notice, reassurance about card usage, payments, and rewards, and access to FAQs addressing common concerns and education on Visa-specific changes

3.3 During migration

Customers received timely in-app and email guidance at key moments, supported by clear status indicators and minimal required actions.

3.4 After migration

Customers received confirmation of a successful transition and easy access to support if issues arose.

Planned staged release across platforms

4. UX & Communication Design

I’ve established consistent messaging across channels, creating UI patterns for migration alerts and confirmations, simplifying language to reduce anxiety, and validating flows with teams handling real customer issues.

Clear communication with customers on what to expect and how to navigate through each period.

Letters send out to individuals nearing to migration date

Takeaway

In regulated environments, design functions as risk management—clear ownership and shared understanding prevent downstream issues, and customers care less about what changes than whether they can continue to trust the service.

Why this matters? This work demonstrates my ability to lead complex, multi-system migrations, design for clarity, trust, and continuity, and operate effectively in regulated, high-stakes environments while balancing customer experience with operational and compliance requirements.

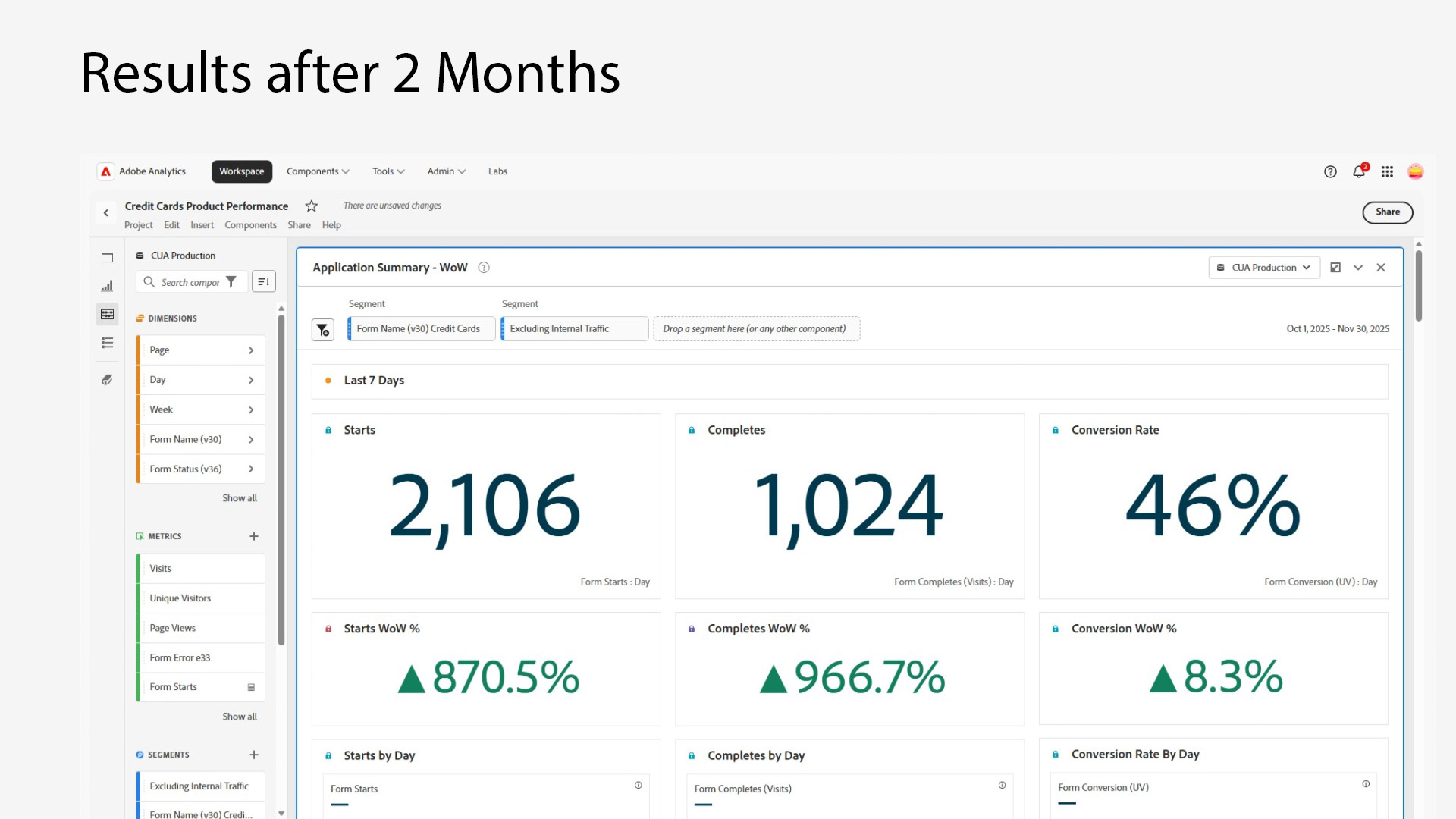

Increased performance and conversion rate

After 2 Months Data